Unlocking the Power of Connected TV in India A Promising Advertising Avenue to Explore

Gone are the days when we waited for the 8:30pm show on our favorite entertainment channel on TV and sat together to watch it. With mobile being our constant companion, VOD (Video on Demand) platforms have redefined how we consume content every day.

In fact, as a fast changing behavior in the US, watching VOD is evolving from small mobile screens to bigger screens! Yes, this is referring to Connected TVs - the newest kid on the block

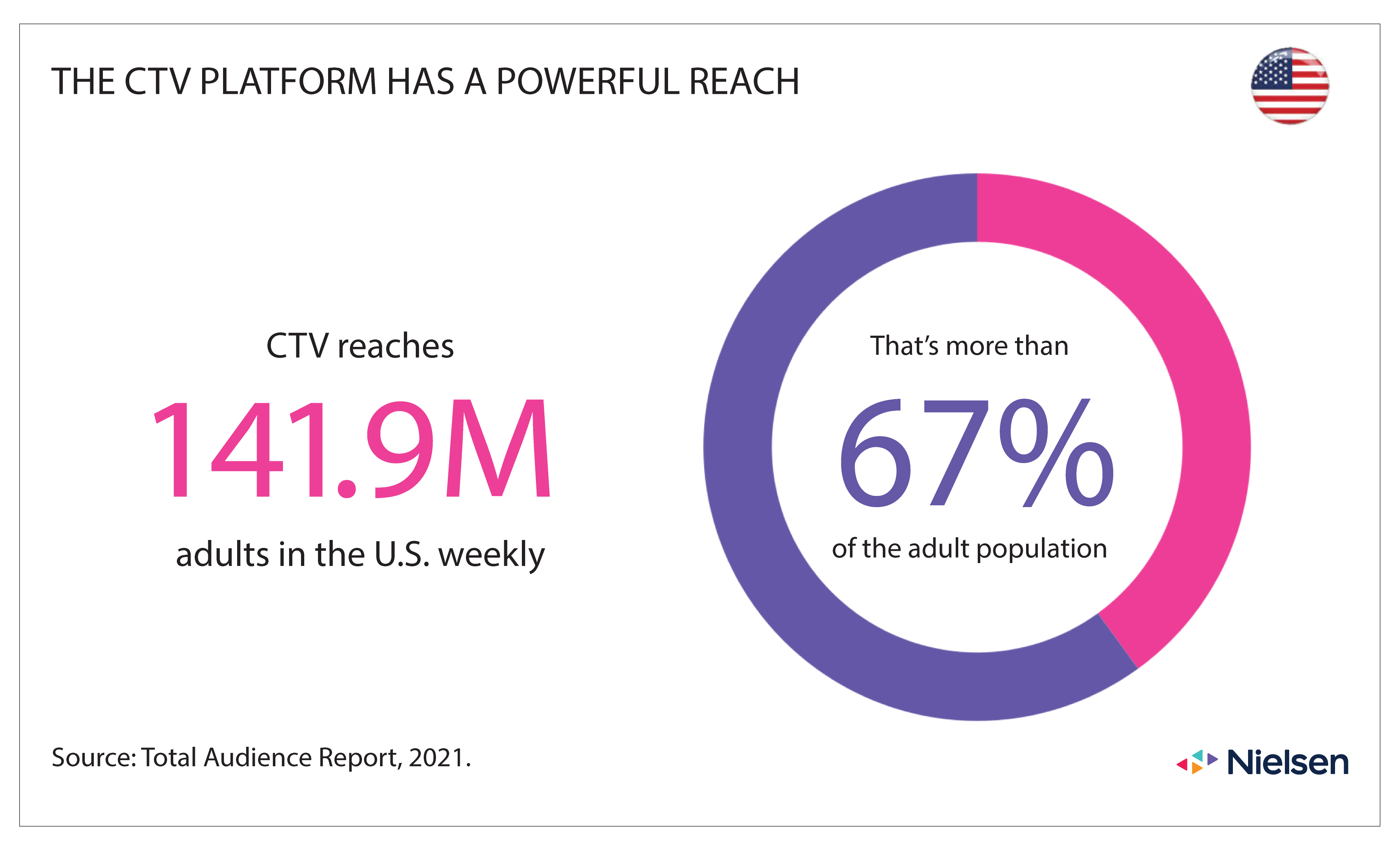

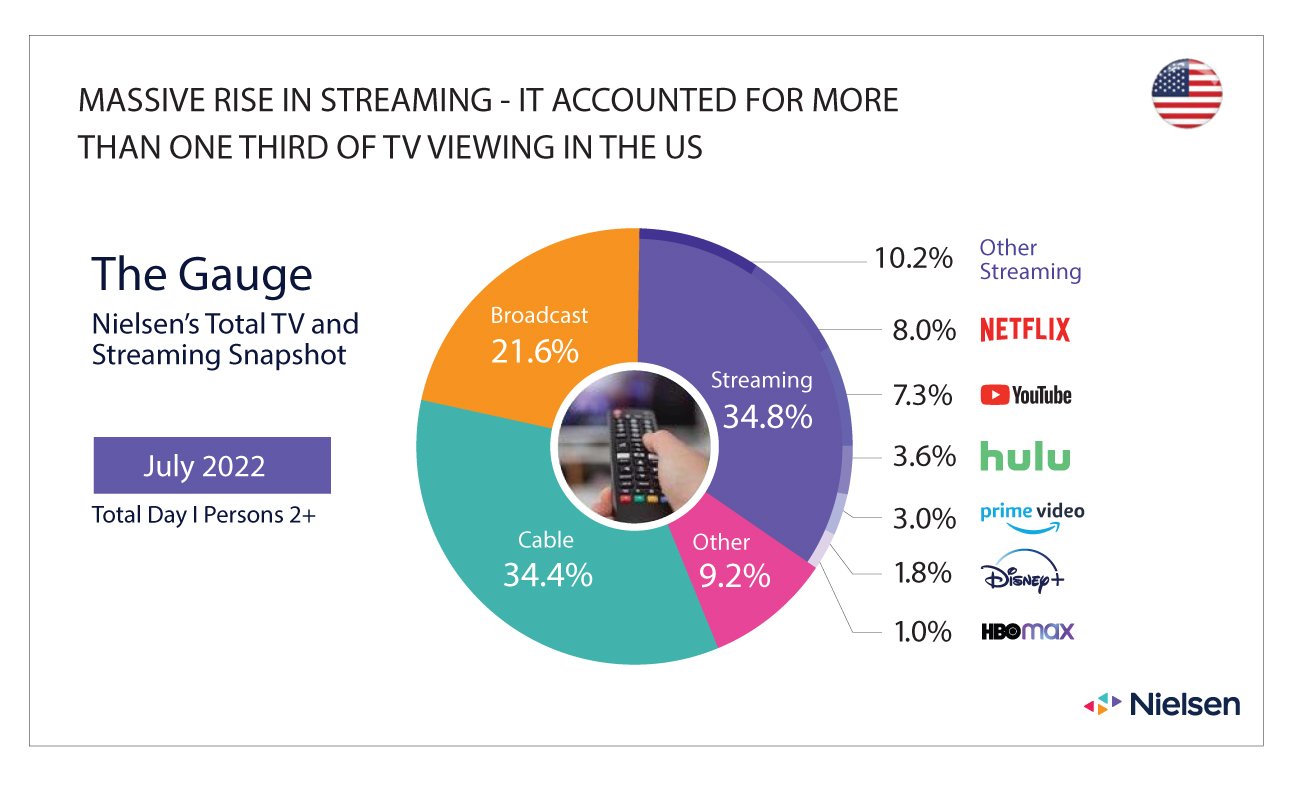

According to the Nielsen Total Audience Report, 2021, CTV reaches 141.9M adults in the U.S. every week - which is more than 67% of the adult US population! Daily time spent on video watching through connected TV has also increased by 38% over 2018 to 2020 with one out of 5.5 hours spent watching video, being spent on Connected TV. Naturally, streaming accounted for more than one-third of TV Viewing time in the US with platforms like Netflix and YouTube accounting for the largest share within this pie.

Historically, Advertisers have followed media where people spend their time and CTV is no different, with increasing Ad spends on platforms like Roku, Hulu, Samsung Ads, Amazon, Vizio, YouTube TV, Tubi, etc.

Nielsen also rolled out CTV Ad measurement in the US to enable the ecosystem to transact with confidence coming to the Indian market - and zooming out on the digital landscape at large, we see that more than half of India has digital access now and are active internet users. 3/4ths of these audiences watch videos - however, mostly on their mobile devices (Source: Nielsen’s Bharat 2.0 report). Interestingly, even with smaller screens to watch videos on, Indians spend 1/4th of their time on their smartphones watching videos which is 2.3 times the share of time spent by Americans on their smartphones.

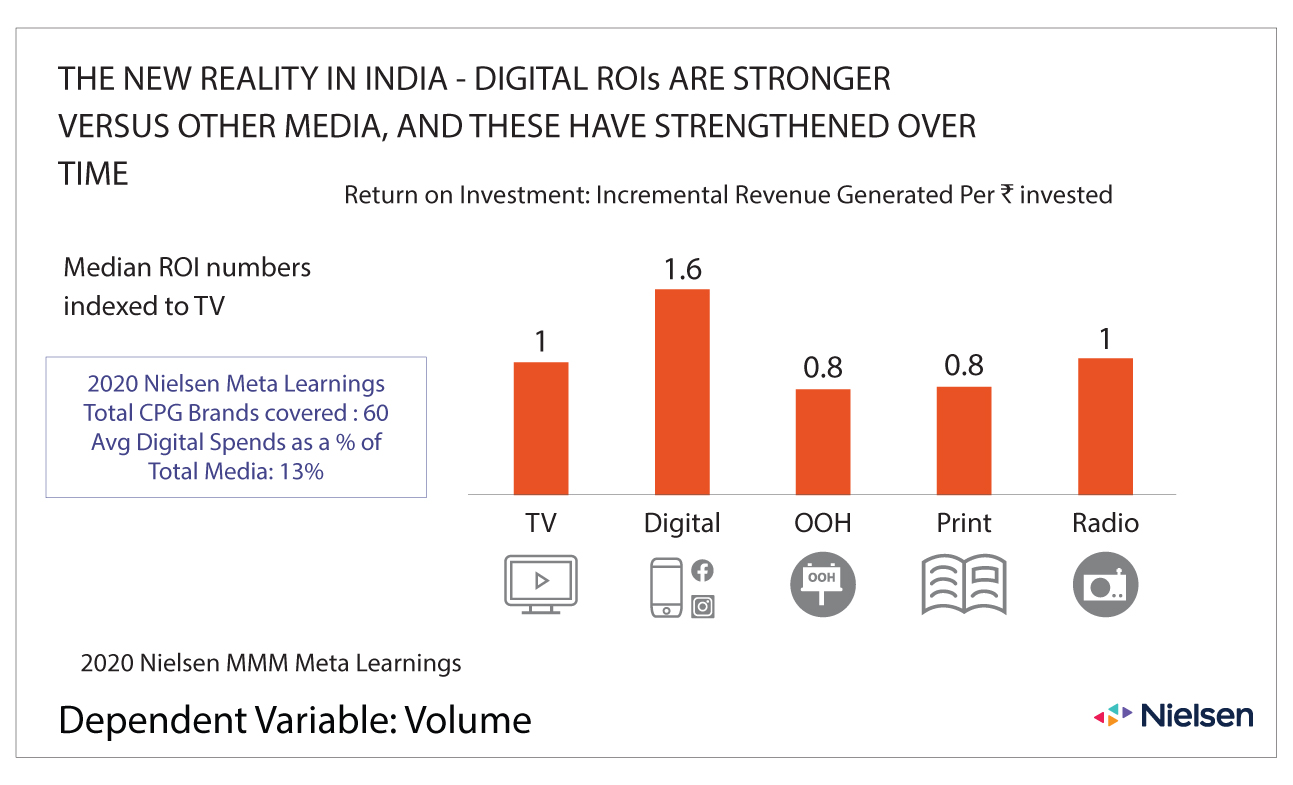

Due to increased engagement, coupled with easily available metrics by Ad format type, length, etc (Carousel vs Video vs Static Display, etc) Digital as a medium in India garners the highest ROI, with an incremental of 1.6 times revenue generated for every rupee spent on Digital indexed to TV, as per 2020 Nielsen MMM Meta Learnings report.

Nielsen already measures Reach & Frequency along with Brand & Sales outcomes for Digital campaigns in India. These are comparatively less complex to measure for forward-leaning devices like Laptops/Desktops and mobile phones, where viewing behavior is a lot more individualistic. However, it gets further tricky for Connected TV - with the possibility of more than one consumer behind the screen at any given time. The Indian industry currently has a challenge of establishing Reach for Connected TV through an independent third-party Measurement. With spends increasing on Connected TV, this is much needed.

Unlike Linear TV, which has one common denominator that tracks viewership and market size across Mode of Signal Reception (MOSR), Connected TV has multiple stakeholders involved which makes it more fragmented and hence complex to unify the Reach build-up and ROI measurement. This fast-growing CTV ecosystem includes Device manufacturers, FASTs, Streaming platforms and Programmatic Platforms. What makes it even more difficult is the fact that there is no standardized way of currently tracking the number of co-viewers of CTV in India. This, however, is being done in the US - where Nielsen rolls out Demo efficiency rates which is defined as the rate at which your tracked ads were delivered to a given demo (Demo Efficiency Rate) and target demo (Target Demo Efficiency Rate) to understand effectiveness.

This, and so much more can be tracked on Connected TV that opens avenues for larger audience Reach while retaining the sharp targeting ability of Digital. With the right and timely kind of investment and collaboration in exploring measurement of Connected TV, Indian advertisers can change the game of advertising in India - let’s together embrace the new kid on the block and reap the benefits of technology on our fingertips and now in our living rooms as well.